If you tried to buy or sell a home in Thurston County last year, you probably felt it. The market was heavy. It was a grind. Every transaction felt like it took twice the effort of previous years. But feelings aren’t facts.

When I sat down with the final data for 2025, I found a story that didn’t match the sentiment I commonly heard from buyers and sellers. If you listened to the national headlines, you would think the market fell off a cliff. It didn’t.

Total closed sales for residential homes and condos combined in Thurston County were down just 0.23% year-over-year. That is statistically flat. The volume of homes sold barely changed.

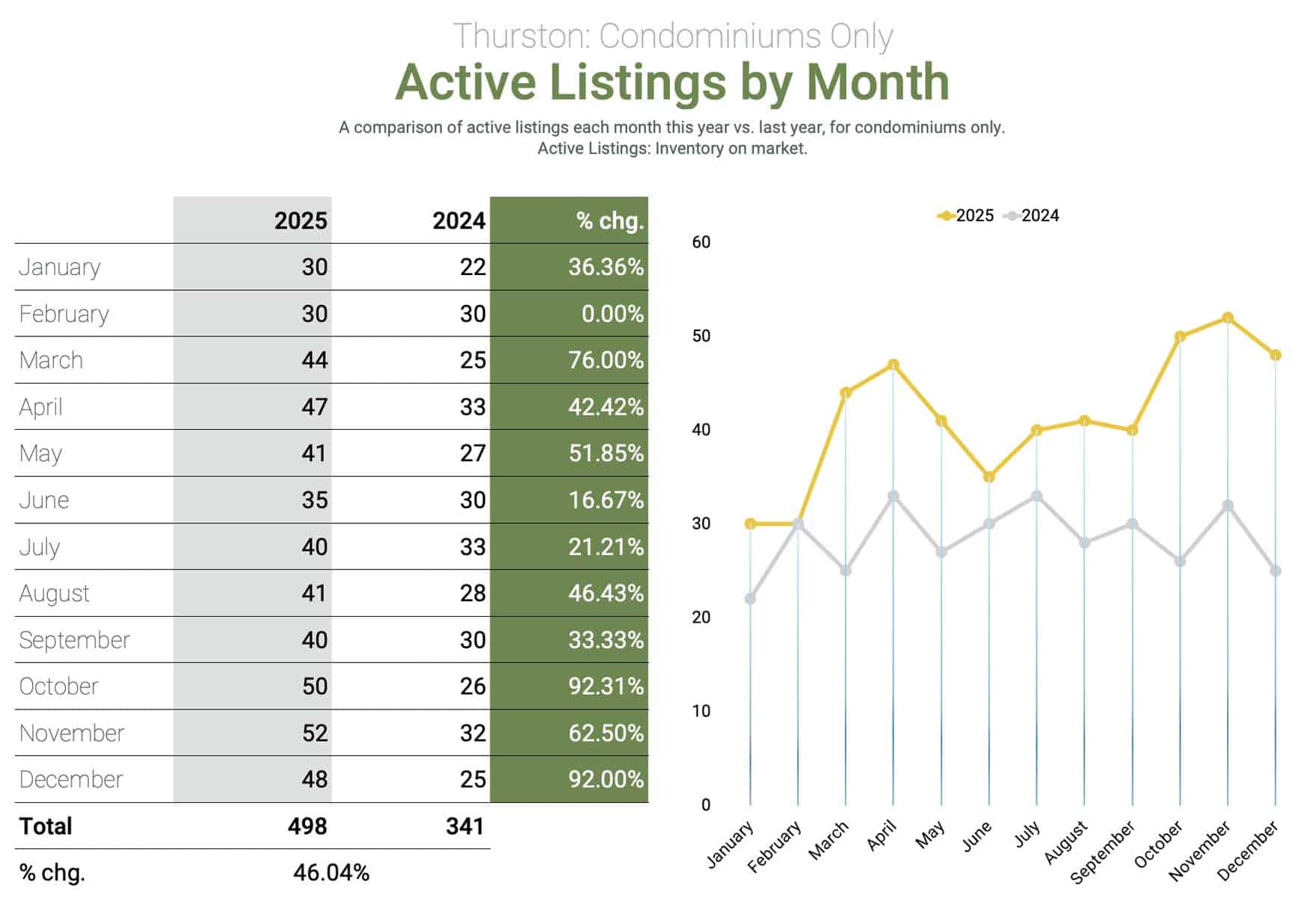

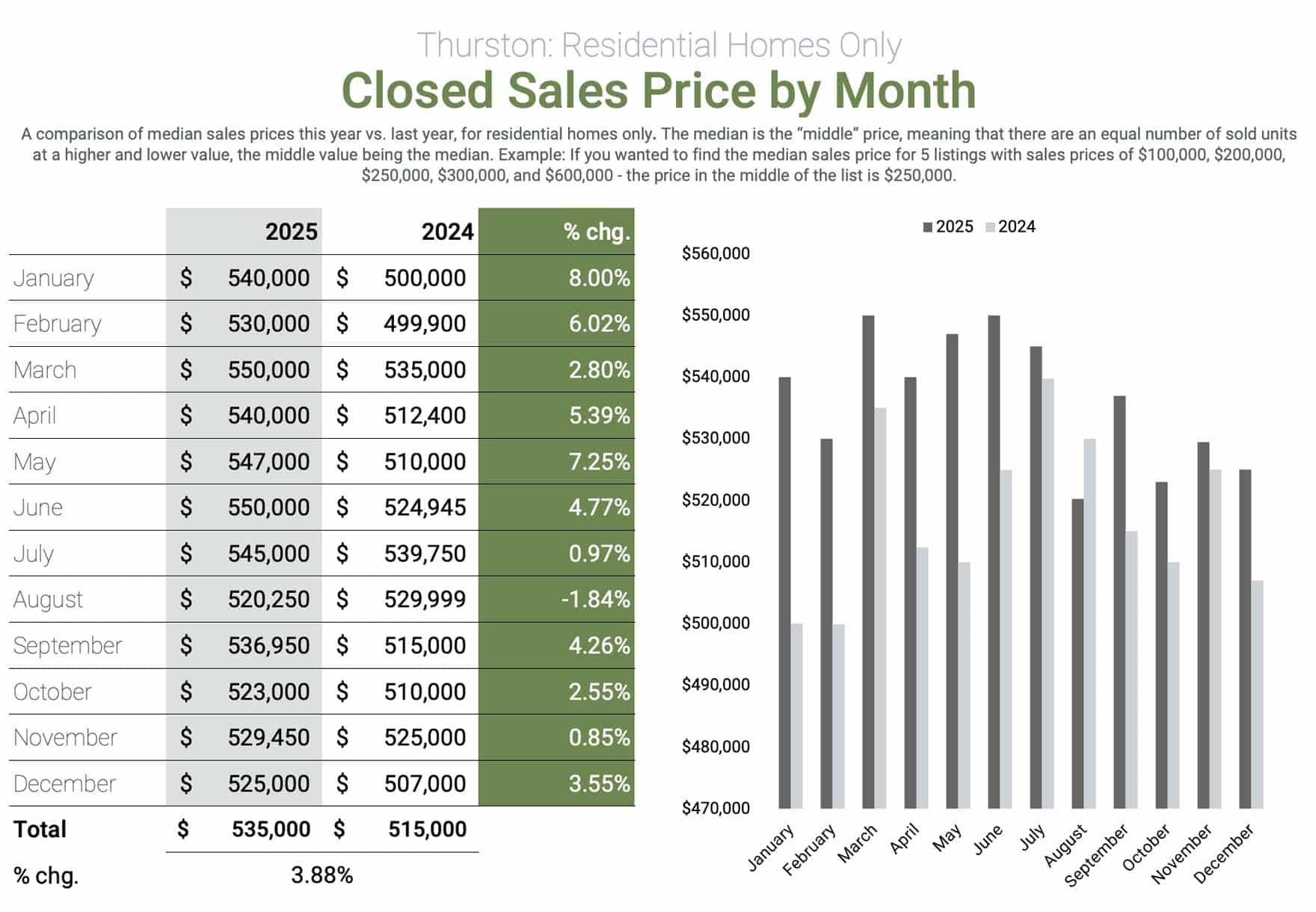

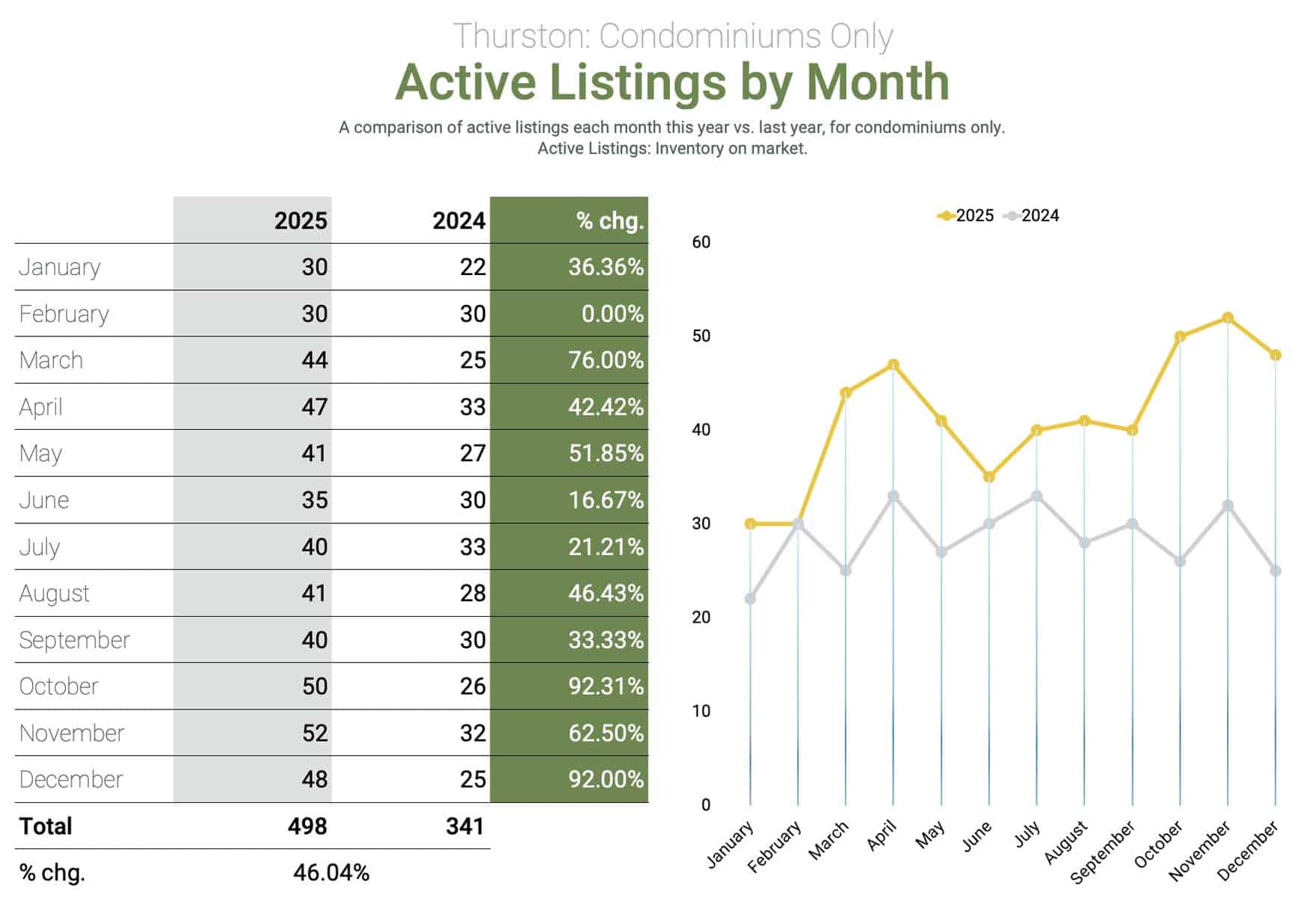

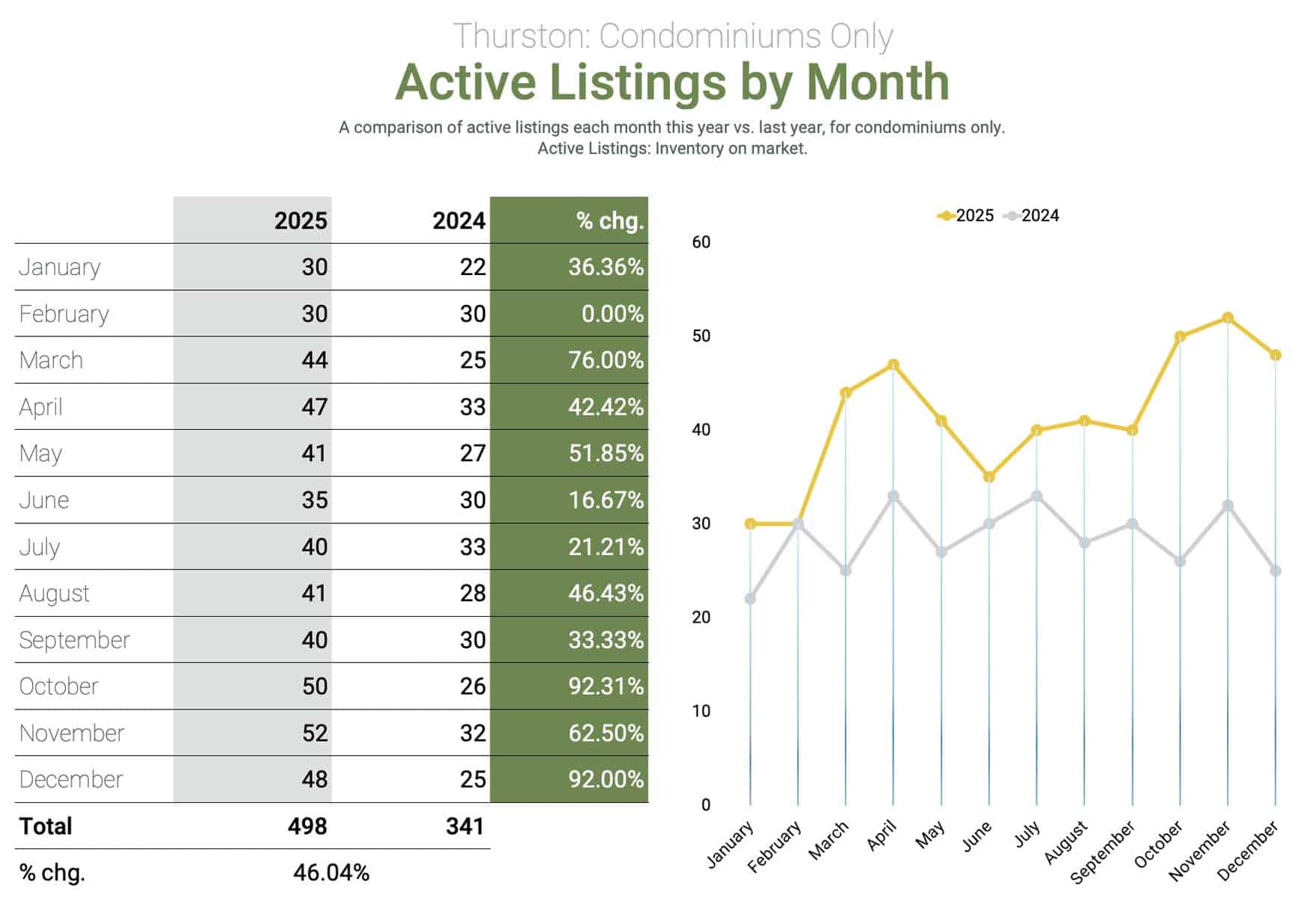

So why did it feel so different? While sales stayed flat, active inventory surged. We finished the year with active inventory up over 38% compared to 2024. In a typical market cycle, when you see supply spike that hard and demand stay flat, basic economics tells you what should happen next. Prices should tank. That did not happen here. The median price for a single-family home in Thurston County actually rose. It went up nearly 4% to finish the year at $535,000.

This is the Local Disconnect. We saw an increase in choice and supply, but sellers didn’t lose their equity. They just lost speed.

Here is the breakdown of exactly why that happened, what started to drop (condos), and what the data says about 2026.

The narrative you heard all year was about a “national slowdown” or “The Great Stall.” And across the broader Northwest MLS region, we did see a significant shift toward normalization.

Across the 27 counties in the Northwest MLS, inventory built up faster than it did here locally. The NWMLS average for months of inventory rose to 2.83 months.

That is the environment the rest of Washington was settling into. But Thurston County stayed tighter. While the region drifted toward 3 months of supply, we ended the year at just 2.21 months for residential homes.

We typically feel the ripple effect from King and Pierce counties. Historically, when big economic waves hit Seattle, they roll south and eventually rock the boat down here in Olympia. But the dynamic of the relationship between the Seattle engine and the South Sound is always stabilized by our local anchors.

Thurston County has a permanent breakwater: The State of Washington and Joint Base Lewis-McChord. These two massive employers provide a floor of stability that volatile tech hubs do not have. Even when rates are high and inflation is annoying, our homeowners aren’t forced to sell because their jobs aren’t tied to venture capital or stock prices.

The Proof is in the Distress Data:

Foreclosures are a non-story locally. Nationally, you might hear about foreclosure upticks, but those numbers are still 40% below pre-pandemic levels. Here, inventory rose simply because homes took longer to sell (81 days on average), not because banks were forcing sales.

This brings us to the most important distinction of the year: We are in a correction, not a crash. A crash happens when values plummet due to forced selling and distress (think 2008). A correction is when the market slows down to find a new equilibrium after a period of overheating.

In 2025, sellers weren’t desperate; they were just recalibrating. Because there was no distress, prices held firm rather than collapsing. We corrected the pace, but we kept the value.

If you own a single-family home in Lacey, Olympia, or Tumwater, the headline for 2025 is actually quite boring. And in real estate, boring is profitable.

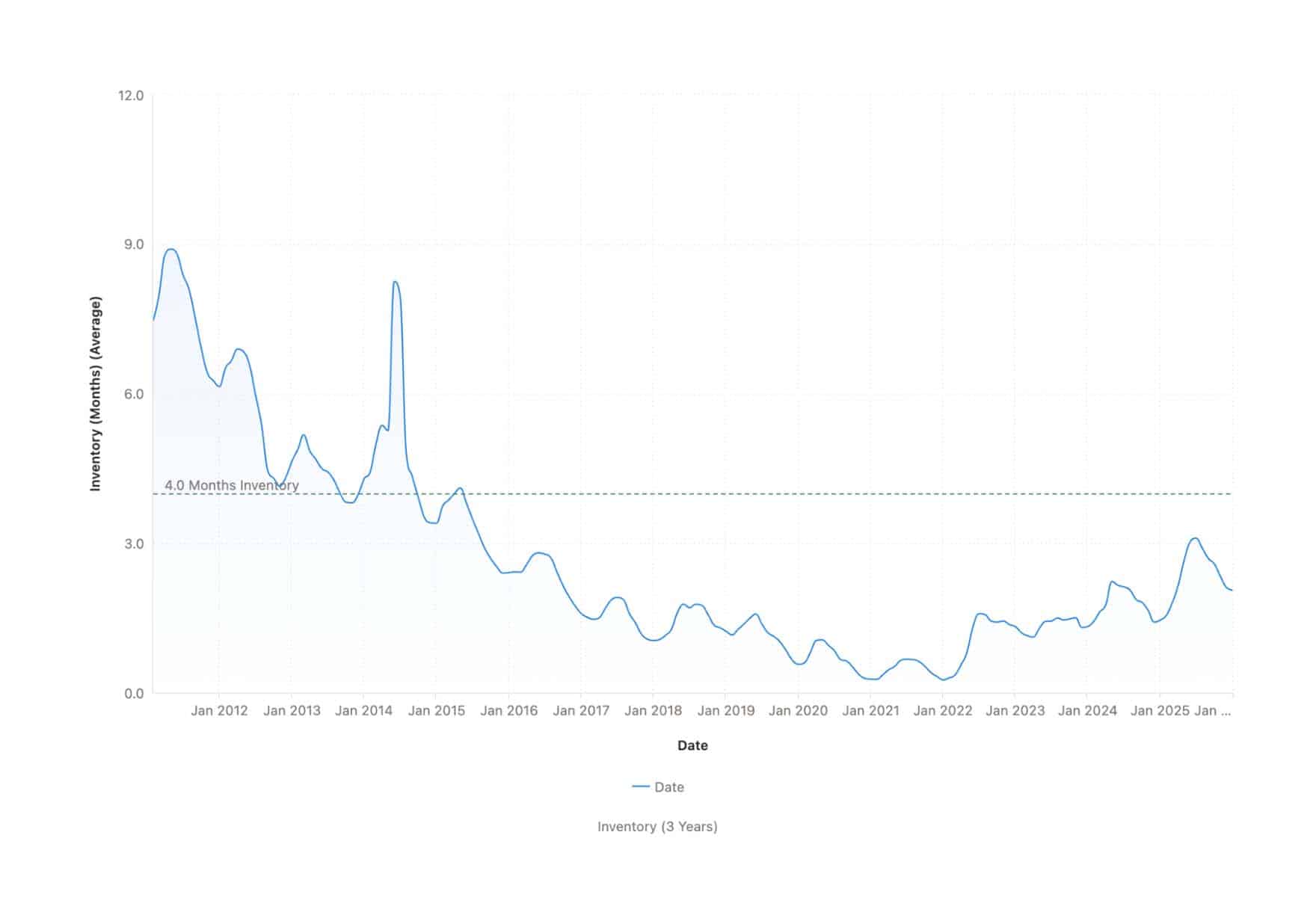

Sellers who were patient got their price. We never crossed into a true “Buyer’s Market.” We stayed in what I call a “Patient Seller’s Market.” You still have leverage, you just don’t have speed. Quick Definition: How do we measure “Months of Inventory”? You hear me use this term constantly, but here is how we actually calculate it. Imagine that zero new homes came on the market starting tomorrow. “Months of inventory” is simply how long it would take to sell every single house currently for sale, based on the current pace of buying.

We ended the year at 2.21 months. Technically, that is still a Seller’s Market. But compared to the “2 weeks of inventory” we saw in 2021, it feels slow. That shift in feeling is the “correction” we are living through.

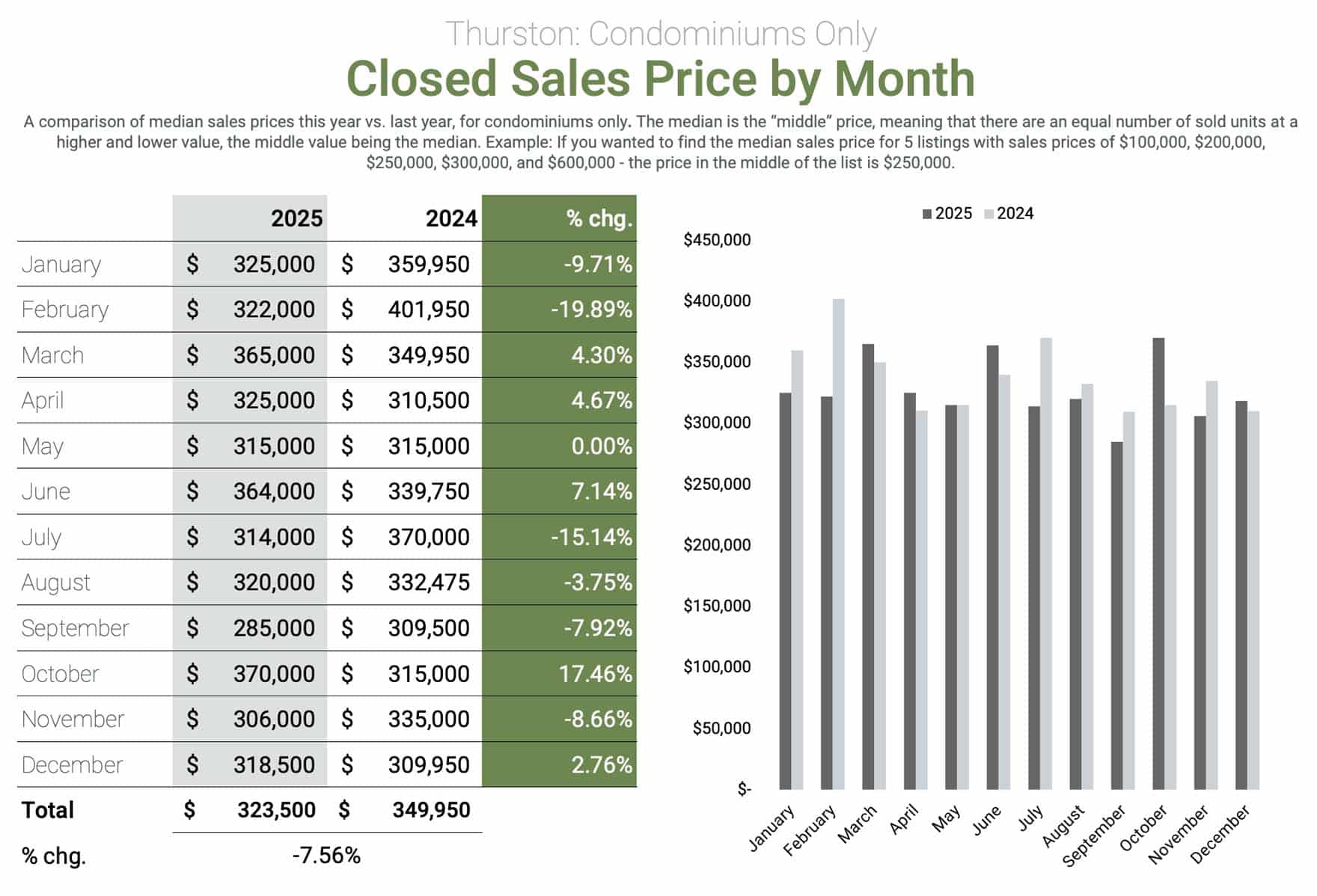

While single-family homes held steady, the condo market took a hit. This is where the friction of 2025 turned into actual volatility.

It comes down to the monthly payment. Condos are typically the entry point for rate-sensitive first-time buyers. But in 2025, rising insurance premiums and regulatory costs drove HOA dues up.

When HOA dues jump by $100 or $200 a month, that cuts directly into a buyer’s purchasing power. A buyer looking at a $325,000 condo with a high HOA fee is often paying the same monthly total as someone buying a $400,000 house. The math stopped working for many people.

You are selling a payment, not a price. With nearly 10 months of inventory, condition is your only leverage. You cannot sell a “project” in this market unless you are selling it at a “project” or “investor” price. If your unit needs paint or carpet, do it before you list.

Let’s talk about the dirt. If you drive around Thurston County, you still see frames going up. It is easy to assume builders are full steam ahead. The reality is more nuanced. Builders are building, but they are incredibly defensive right now. They are protecting their margins.

In today’s rate environment, that $105,000 gap is a massive monthly payment hurdle. Because of this, builders are leaning heavily on incentives (buying down rates to the 5s, covering closing costs) rather than dropping their headline prices.

You may have heard that single-family zoning is changing to allow fourplexes and duplexes in traditional neighborhoods. While the law has passed, the implementation is slow. We are currently in a transition period. Cities like Olympia, Lacey, and Tumwater are still finalizing their codes. Don’t expect to see fourplexes popping up on every corner in 2025. Financing costs are high and the regulatory dust hasn’t settled yet. This is a story for 2026.(Note: I will be publishing a dedicated deep-dive on HB 1110 and exactly what it means for your property rights in the coming weeks. Stay tuned.)

Thurston County is not one big bucket. The experience of selling a home in a master-planned community in Lacey is very different from selling acreage in Rochester. That 2.2 month inventory average is a county-wide number.

I don’t have a crystal ball, but I follow the data trajectory. We are entering 2026 in a “Normalizing” phase. We are in the middle of a correction, not a crash, despite what the headlines are telling you.

1. The Inventory Floor: If we cross 4 months of supply and stay there, pricing power will noticeably shift to buyers. We’re pretty far from there right now, and haven’t seen that high of an inventory since May 2015. There would have to be some pretty drastic economic changes for that to happen in 2026.

2. Rates (10-Year Treasury): Mortgage rates generally track the 10-year Treasury. If rates dip into the high 5s, there is enough pent-up demand to clear inventory quickly. If they stay in the mid-6s, sales volume will remain low.

This is a split market.

We are in a “Patient Seller’s Market.” You still have equity, but you no longer have speed. Here is how to win in 2026:

I want to leave you with one final thought. If you turn on the national news, you are going to hear about a housing market that doesn’t exist. You will hear about “national averages.” But there is no such thing as a “national housing market.” There is only the house you are selling and the neighborhood you are buying in.

When a major national event happens, like interest rates spiking or a recession fear, it affects everyone. It creates the “weather.” But how your specific house weathers that storm depends entirely on where it stands.

The National Weather: High interest rates and fear of a recession.

The Local Outcome: In Austin, Texas, that weather caused prices to crash. In Thurston County, because of our state jobs and lack of speculative building, that same weather just caused a slowdown. Same storm, completely different damage report.

I talk to a lot of people who are “waiting for the market to clear.” They are waiting for a national green light. Here is the hard truth: If you wait for a national signal, you will miss your local window. By the time the national news tells you it is “safe” to buy, the best inventory in Thurston County will be gone, and multiple offers will be back.

Do not make life-changing financial decisions based on what is happening in Florida. Look at the data right here in the South Sound. If you are trying to make sense of where you fit in this current market, I am here to help. Whether you are thinking of selling, buying, or just want to know what 2026 looks like for your real estate goals, let’s connect.

Thank you for your time, I hope you found this helpful.

-Nate Burgher

Nate brings a rich tapestry of experience to real estate, from his early days working at his family’s marina in Olympia to building a successful media business. As a former EMT, baseball coach, and entrepreneur, he’s worn many hats – but his guiding principle has remained constant: selflessness. Whether he’s helping families find their perfect home or guiding sellers through a successful sale, Nate combines his marketing expertise, local knowledge, and commitment to putting clients first. When he’s not serving clients, you’ll find him spending time with his wife Stephanie and their two daughters, EmmyLou and June.